Payroll reductions by a growing list of tech companies have done little to impact the overall...

Jobs and wages and workers, oh my!

The labor market is strong, wages are rising, and the workforce has shown some fight.

- Today’s job market is tight, with unemployment near 50-year lows.

- Wages are on the rise, which is a mixed blessing for the economy.

- Where are all the workers? Most of them are actually at work.

The job market is strong right now, which is a good thing for workers.

The list of factors causing economic distress today is long: widespread inflation, stock market swings, supply chain shortages, and global unrest, to name a few. But difficulty finding a job isn’t one of them.

The job market is strong right now. Really strong. In fact, it’s almost never been easier for workers who want a job to find one.

The red line in the chart below shows the U.S. unemployment rate:

The unemployment rate is the most common gauge of the U.S. labor market. It shows the portion of the workforce that’s actively looking for a job and can’t find one.

Typically, the lower the red line the better. Notice that today’s level of 3.6% is near its lowest point in 50 years.

Other measures of the labor market are showing strength as well:

-

The number of people receiving state unemployment benefits is at its lowest level since 1969.

-

Employers have added over 400,000 new jobs to the economy for each of the past 12 months in a row.

-

There are 11.5 million job openings, which is the equivalent of two open positions for every unemployed worker seeking a job.

These measures do have some limitations, as they lump together the market for all jobs. The national labor market is actually composed of many smaller markets separated by industry, qualifications, region, and nature of the work.

But broad measures like these are helpful in providing data that paint an accurate picture of our general situation. And what the data are telling us is clear: the job market is historically strong right now.

Wages are on the rise, which is a mixed blessing for our economy.

As might be expected, tightness in the labor market is driving up wages. With more positions open than workers available to fill them, businesses are competing for talent by shelling out higher pay. It’s good old-fashioned supply and demand.

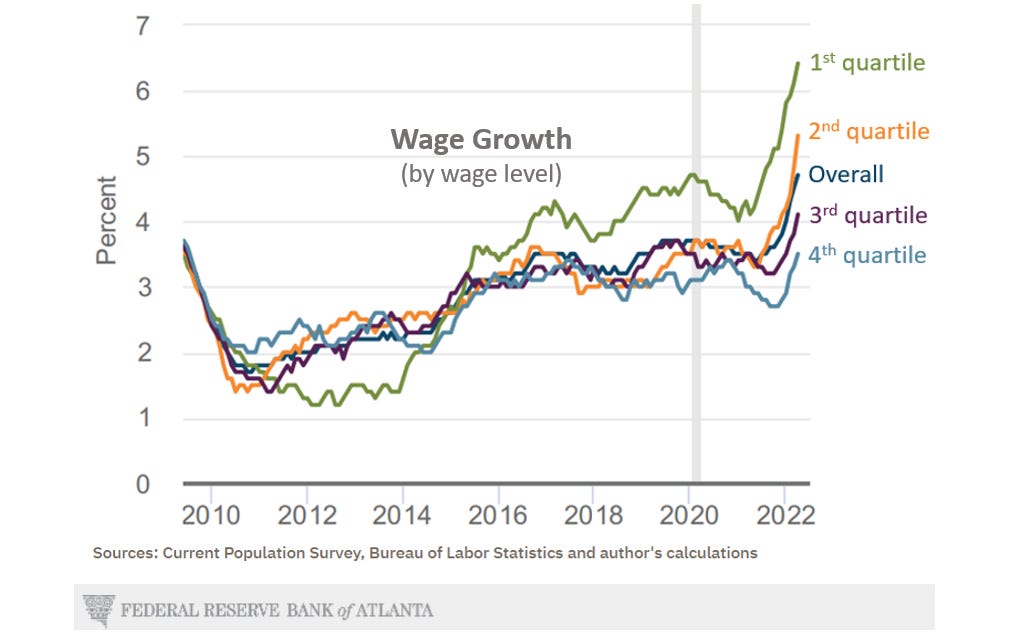

The chart below shows annual wage growth for workers by wage level:

Overall, wages have grown faster lately than any time in recent memory. And the green line in the chart above shows that gains for the lowest wage workers have been the strongest, particularly since the darkest days of pandemic shutdowns.

Higher pay typically means workers benefit. But the data in the chart haven’t been adjusted to account for inflation. This is important because inflation erodes the purchasing power that higher wages might otherwise give workers.

And right now, inflation is outpacing wage growth, which is a problem. This means workers aren’t actually realizing the benefits we’d expect from these wage gains.

In addition, there’s growing concern about the extent to higher wages might lead to future inflation as businesses increase prices to absorb the higher cost of labor.

While today’s inflation is due more to supply chain issues than labor costs, that could change as wages climb higher and workers continue to be in short supply.

If wages are up and jobs are still open, where are all the workers?

As people see “help wanted” signs and hear stories of businesses not being able to fill positions, much of the conversation about labor shortages has mistakenly focused on people not wanting to work.

While it’s true that more than 40 million people left their jobs last year in a phenomenon known as The Great Resignation, there’s more to the story. Most of those job-quitters either quickly switched to a new role or have returned to the workforce as of late.

The blue line in the chart below shows the U.S. labor force participation rate:

The labor force participation rate is the portion of our population that is working or actively looking for a job. The blue line above shows that participation has bounced back to within about 1% of pre-pandemic averages.

There are several explanations for the remaining gap. Some of it is due to a mismatch between baby boomers retiring and the smaller generation of younger people entering the workforce. Another part of it is due to “hidden unemployment” of potential workers who’ve left the workforce but still want to work (which is a topic for a future post).

Either way, the gap in participation is hardly the sole culprit for today’s tight labor market. As noted earlier, employers have created over 400,000 new jobs to be filled in each of the last 12 months is a row. So strong hiring demand is a major factor in labor market tightness as well.

How long will this all last? That’s hard to say. What we know is that today’s job market is strong, wages are on the rise, and people are working.

Stay tuned, more to come.

-1.png?width=50&name=Untitled%20design%20(32)-1.png)

.png?height=200&name=back%20to%20work%20(300%20%C3%97%20175%20px).png)